How to Sell Life Insurance Online for PL Rating Users

Ian Ryan

10/12/2021 · 8 min read

Agencies that take a multi-channel approach to selling life insurance can better meet the needs of their agents and customers. Allow customers to buy from your website, use Quote & Apply yourself as an agent, and now you can create life insurance opportunities within PL Rating. With BackNine’s Quote & Apply integration for Vertafore’s PL Rating, agents can see life insurance rates within PL Rating and click to complete a pre-filled application. Setup is simple and the integration is free to use. Here’s how to get started.

-

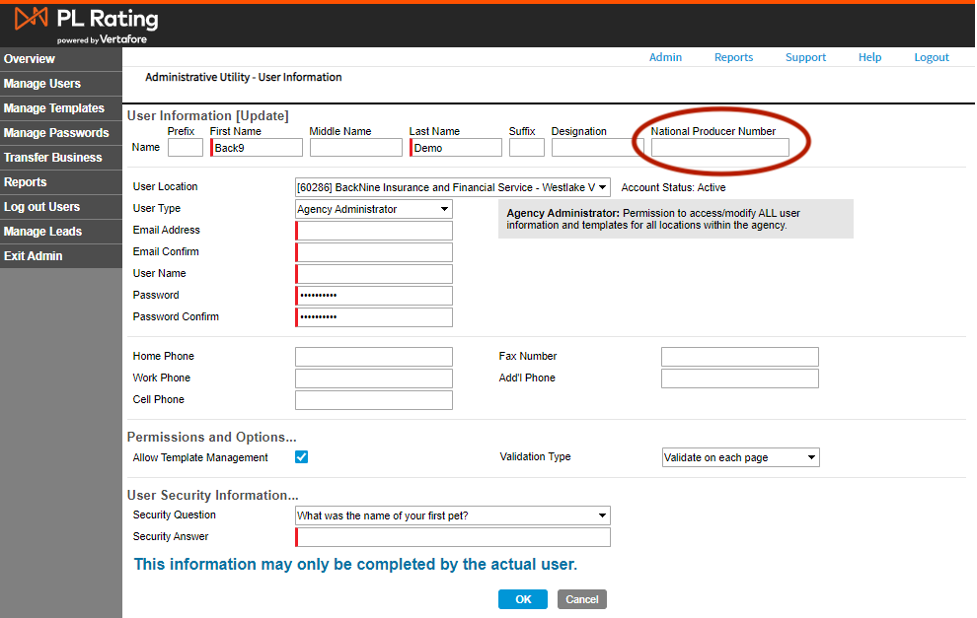

Log in to PL Rating and select Admin -> Manage Users -> Edit, then enter your National Producer Number in your settings. This will enable the integration for newly created quotes. Quotes created prior to entering in your NPN will continue to prompt you for your NPN when bridging to Quote & Apply.

-

Each quote you run within PL Rating will cause a life insurance teaser rate to populate below it. You can then click the BackNine logo to be redirected into your Quote & Apply website, or you can click the PDF button to send your client a PDF of the default quote ($500,000 10 year term).

-

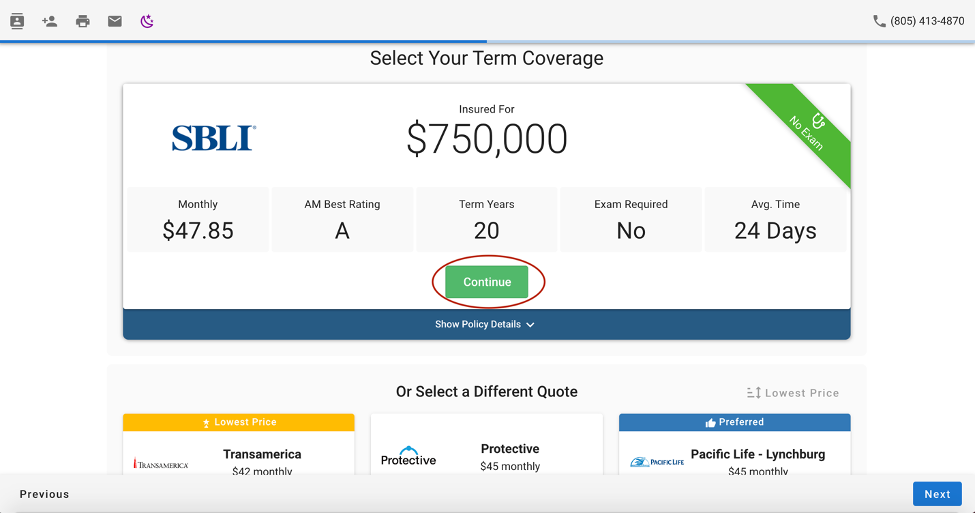

Clicking the BackNine logo will redirect you to Quote & Apply and allow you to pivot to different products, coverage amounts, and carriers. We recommend doing this with each quote as the teaser quote shown in PL Rating assumes "best rate class" and may not match your client's actual health rating or insurance needs.

-

As soon as you arrive in Quote & Apply, an eApp will be created in BOSS. If email and phone number are provided, the agent will receive a lead notification email and the insured will receive an intro email from the agent.

-

After picking a coverage amount, reviewing options and selecting a product, click on the "continue" button to complete a carrier specific eApplication.

First things first, let’s make sure you have completed the necessary steps to start writing business.

-

Create your account from within PL Rating (see above) or at www.back9ins.com and login (make sure you select Vertafore from the “how did you hear about us” dropdown)

-

Complete the Welcome Tour

-

Update information

-

Complete online contracting for carrier appointments

-

Customize Quote & Apply for your clients (if applicable)

-

Add Quote & Apply to your existing website (if applicable)

-

Decide on first client or marketing effort:

a. Many agents write their first policy on themselves or family members to see the case all the way through.

b. Once you complete your first one, you will have a higher confidence in the system and a better understanding of the process.

c. Cross-selling for new mortgages or business protection policies can also be a good place to find early traction. -

Sending marketing template or verbiage via our “Marketing” tab can provide a specific call to action for an existing client base.

-

Once you and your client are ready to begin their quote, you can either “Quote Request” for help from our internals, or “Launch Quote & Apply” from the left menu to complete the entire process online.

-

After the contact information (email/phone) is entered, a link to review and complete the application will be automatically provided to your client. At this time, you can either complete the application for them, or allow the client to review and complete the application on their own time. There is always one version of the application and both the agent and client can be in the application simultaneously.

-

After the policy is submitted, both you and your client will receive confirmation. Using BOSS, you can stay up-to-date with any and all policy requirements from the carriers as we go. You will also be able to chat directly with your designated case manager, concierge and case support staff.

How Quote & Apply Works

Step 1: Quote in seconds with industry leading carriers for multiple product types

Step 2: Apply from anywhere in minutes using a cellphone, computer or mobile device

Step 3: Schedule the medical with ExamOne (When Exam is Required)

Step 4: Enter the physician information for instant APS

Step 5: Take payment information

Step 6: DocuSign the application

Contracting

It’s great to have access to so many carriers, but it’s even better that you can get appointed to any/all by completing our proprietary online contracting ONCE.

You may only assign commissions to your agency if you and your agency licensed in all states you plan to sell in. Quote & Apply will halt you if you or your agency are not life licensed.

5-minute Online Contracting - for you, your agency and your sales team.

Utilize this proprietary online contracting process to get automatically appointed "just in time" with more than 60 industry leading carriers.

For you skeptics out there… dual-appointments are available! This means you can have more than one appointment with a given carrier through multiple GAs.

*In most cases you won’t need to cancel your current GA/IMO/FMO relationship to try us out. We’ll simply get your additional appointment for BackNine as soon as you submit a case with us.

Errors and Omissions Insurance

E&O is required prior to submitting your first case. What information do you need on the COI?

Your Legal Name

Your Business Name - Must hold resident state agency life license. Non-resident required for both the agent and business when writing outside of resident state.

Your Downline Agents Name(s)

In the past the carriers have accepted the language for “… agency and any or all sub-producers are protected by this agency E&O policy” Unfortunately, times have changed and so have the requirements. As of 6/2020, many carriers now require for every agent to be explicitly named in the E&O COI.

Example:

Name: Daniel Gates

Agency: InsuringYou.com

Agents: Joe Doe, Jane Fonda, Mary Street

Not:

Daniel Gates

Insuring you – Section 1.3 – Agency and all team members/sub producers under contract with Agency, are protected under this E&O.

Video walk-through of completing the contracting in under 5-minutes: https://youtu.be/Z7lNXFciZvU

Commissions: How do they work?

-Commissions are paid directly from the insurance carrier to our agents or agencies. These commissions will be direct deposited into whichever bank account they setup in their settings.

Life Insurance license must be held by your agency in order to assign commissions to a business account

-

They are typically paid within a few days to a week after a case goes in force, depending on the carrier’s payment schedule.

-

Commissions are paid as earned by default, however annualization is available with select carriers. Please reach out to Ian or Daniel if you’d like to be considered for annualization.

-

Commission schedules and payouts are made public to all agents who have a BackNine account. To view the commissions for every product and carrier offered through BackNine, log into BOSS at Back9ins.com and click on “Products” on the left. You can filter between different lines, product types and carriers and view the first year, renewal and excess commissions for each.

Marketing your Quote & Apply Hyperlink

Direct new and existing clients to a free quote from you by hyperlinking the below image or catch line in your email signature.

Leverage a hyperlinked image or catch line in your email signature to grab customer’s attention:

• “Your Life Insurance Quote in Seconds”

• “Want to apply for life insurance on your own free time? Click here to run quotes in seconds and apply when it’s convenient for you.”

• “Too busy to meet with an agent to set up protection? Click here to get your free quote in seconds.”

Example Verbiage for Cross Selling Opportunities:

“Hi Friend, I hope you are having a tremendous year!

Thank you for the opportunity to protect/cover your “______” It is a pleasure to work with you.

Many people are aware of the importance of life insurance, although few take the necessary steps towards protecting against the unexpected. It’s easier than you think.

From our website, we now offer a quick way for you to get a free quote on your own time.

Please feel free to explore some different life insurance options and let me know if there’s anything I can do to help.”

Q: Why haven’t you written life business with Back9 yet?

A: I don’t know where to start.

How to get your first case in underwriting by next weekend:

Step 1: Login and confirm your account information (Password Sent Automatically)

Step 2: Complete the contracting with your commissions assigned to your personal or business account. *Business must hold valid life license with NPN in all states you write in.

Step 3: Launch Quote & Apply from the left menu of your BOSS account at Back9ins.com

Step 4: Complete the 10-minute application and schedule the medical exam (When Required)

Step 5: Take Payment Information and DocuSign.

Next, our back-office team of superstars will support you and your client through the underwriting process. From submission to commission, we are here to help.

Thank you for taking the time to go through this intro guide. Please reach out to Daniel Gates at (805) 413-7586 or [email protected] or to Ian Ryan at (516) 512-1595 or [email protected] if you need help with anything or have questions.